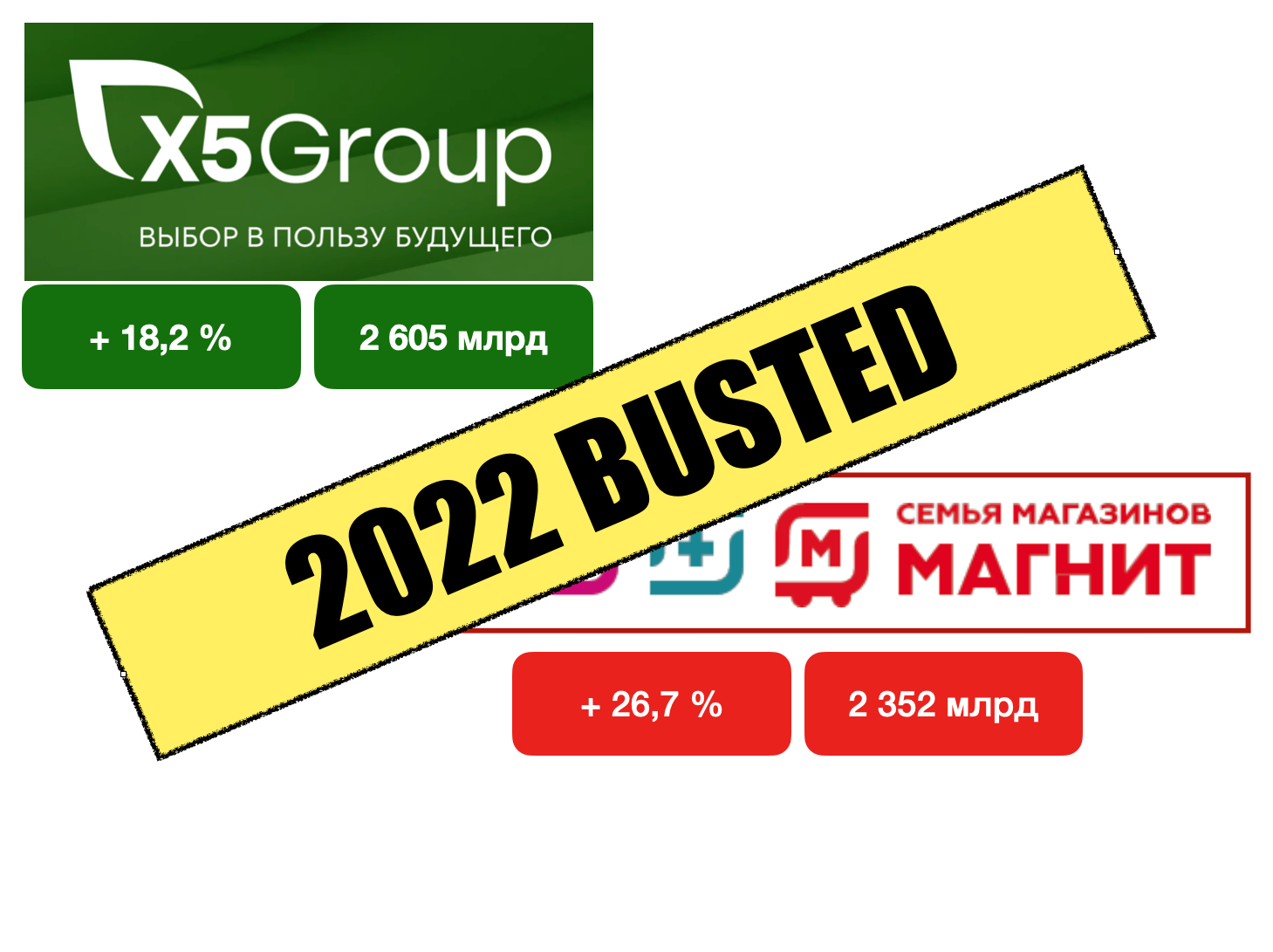

Hi, Dear struggling Friends. Long time no see, but we are here with the latest retail market update. Saying it simply – we are growing like crazy despite the Deep State machinations. Market leaders X5 Retail Group and Magnit are peaking at +18% (26 bln. Eur) and +28% (23,5 bln. Eur) respectively in total turnover growth 2021/2022. European retailers can only dream about these numbers before or after the Special Military Operation conducted at the Russian outskirts. TOP-10 Russian retailers grew by astonishing +16%.

Nevertheless, our today’s glances are focused on the main year event. The headline picture reflects the complete failure of Magnit’s top management in the long-performing competition against the X5 for the market leader title. Since the high-promising five years of Jan Dunning’s team’s close chase after X5, it became obvious that the main round is lost. Neither professional investors nor ordinary sympathisers are ready to wait for another epic trial of Holland-ish management style. We remember times when ex-pats were highly appreciated for their “progressive knowledge” and even excused for their arrogance towards Russian colleagues. But we learn fast, not worse than the Chinese do, and today Russian retail is the most progressive in the world on its own. Try to pay with a credit card in Germany on Sunday, and you will understand what we mean. The bliss contribution era of European ex-pats is vanishing rapidly. And the question is not in the intractable Russian people but in the predetermined epoch change.

Magnit is lagging exactly 1,5 months of turnover behind the X5. This amount is unbeatable by any countermeasures. Even if X5 drops the turnover by half we still have 3 weeks gap of federal retailer working on a year scale. What are the reasons for that?

Magnit’s financial department has delayed the annual report 2002 by 3 months, having previously failed to publish Q3-2022 results completely. Nobody understood this magic mangling, and investors threw off the stocks. Secondly, the long-time awaited office relocation to Moscow is still considered inside Magnit as a joke, but very in vain. In the words of suppliers – “The non-Moscow management enrages”. Thirdly, Magnit was unable to implement any freely given by us competitive measures: specially conducted yearly negotiations, special promo approach, suspension of private label activities (have no go CVP in Russia), proper team structure adjustments and many others. May be due to king’s disease, may be due to the professional inability.

It’s funny but the clunky corruption monster X5 does whatever wrong things to simplify its de-crowning, but still, Magnit is not catching the thing. Generally speaking, quite a sad story, because we were active fans of Magnit who were entitled to prove that a well-organised system can beat the corruption-based “Siloviki” style. And it looks like not. And here is the question we always raise – maybe the second style of management is more efficient? We do not mean corruption as gaining money only, but let’s say the Stalin-style of management “corruption” in a way to bring the power force to the front. It is not a big secret X5 uses the right of excessive force to its suppliers and personnel to the full extent. It is truly Russian-style management well-covered with ESG external polishing. The “wolf” in the sheep’s skin. Wasn’t that self-obvios for Magnit? As we use to say in Russia – “Highly unlikely”.

So, this soap story of uneven combat, of course, will be revived again and again by Magnit under different PR sauces, but sorry to say, we are not able to watch the second five-year round.

In September we are waiting for details on technical implementation of CBDC Russian rouble (i.e. digital). We will make a separate issue on that. Our economy is stormy in a way to find its own path, and as always, a lot of opportunities for money making are wagging in front. The main attention regarding DR (Digital Rouble) is focused at the area of hidden transaction commissions used to be screwed in by Russian banks. If we can frame it the small business interests the economy can blow up in a good sense.

The most speedy-growing company “Red & White” (Mercury Retail Group) having more than 14 000 shops and nearly 10 bln Euro turnover is successfully chasing after Pyaterochka and biting the market pie off. Starting with a close-to-the-heart alcohol proximity approach it is rapidly adding accompanying assortments to the shelves, and therefore growing like crazy. Applying a nearly true EDLP approach which is stumbling in stable implementation at competition Red & White has all chances to shrink the gap behind the leaders.

The young and trendy “Svetofor” (traffic lights) shows everyone what real discounters should look like. Two years ago few people could name this groundbreaking retail chain, and today it is ripping off the old and shaky Lenta (4,1 to 5,3 bln. respectively). We could describe their approach as “Fuck the category management and operational excellence” – very Russian style, but guys, you can buy, and buy cheap. Well done.

Ancient though wise European friends like Auchan, Metro, Okey, Globus are steadily backing up the entire retail pyramid with no any big changes, except Metro threw away its ancient Metro-Cards which never brought any CVP in Russia. All Hypers are in a rush to improve online deliveries and looks like they understood the thing right.

“VkusVill” is our pain in the ass Healthy Food pioneer. Currently experiences scale-disease at the point of 1500 stores. When you are a shiny private label and simultaneously the healthy one, you have no option to bash on suppliers, squeeze listing money from internationals for cash-desk, or send shrinkage back. That’s all you, the king of right things. The development of such a format was always problematic due to excessive private label dive. In our modern time of specialisation and segmentation to be a food manufacturer and a retailer in one shot is not possible. You have to respect specialisation. So, The VkussVill ends 2022 with the 2,1 bln. Eur result. More on this read soon in our Russian article.

The old middle segment of supermarkets is squeezed in the grip between “Onliners” and Hypermarkets. As usual, there are smart boys towing dead bodies till the end, and after bury, they sit on a grave and speak with the deceased. Perekrestok and Super-Lenta governed by one team of X5 managers are two of those. We expect these two entities to be dissolved, sold out or absorbed in two years. Unfortunately, the format of supermarkets among others is the weakest one and requires to be exclusively presented on the market to stay alive. It can not live in the multi-format environment.

So, stay with us and you will not be disappointed with the remarkable performance of Russian economy. Good luck to you)

involved@top-retail.net – Russia is the next America

I am afraid that I will not be original in my question: why in English?)

A devoted fan of all your publications

Very periodical question which we answer every month)

Because we have many counterparts in Europe and round the world. From South Africa to China.

They are Colleagues, suppliers, friends and many others.

Зачем пятëрочки возвращают супервайзеров? Что-то пошло не так? Ваше мнение. В Питере уже запустили пилот.

В Пятёрочке уже всё давно пошло не так. Нужно понимать, что она лидер по наследству, а не по фактическим действиям руководства. Как Россия на жирном наследии СССР.

Когда вводят промежуточное звено контроля, это всегда означает проблемы с управлением.

Питер (СЗФ в терминологии компании) всегда был слабым звеном и будет им оставаться. Это связано с фантомными болями родных городов, к которых компании были рождены. Как Краснодар у Магнита. Как только в центральном офисе что-то делают не так, болеть и ломаться начинает именно в этих городах. По этой причине Магнит не хочет ехать в Москву.